insurance broker valuation multiples

Enterprise value multiples Revenue EBITDA and assets under management AUM are key metrics in a valuation. 2Build value in your agency.

Valuation Insights Insurance Agencies And Brokers Expert Commentary Irmi Com

The table below summarises eVals current month-end calculations of trailing industry enterprise value EV multiples for US listed firms based on.

. As illustrated the current average valuation for large public insurance brokers is approximately 10 times EBITDA. Valuation Multiples by Industry. EBITDA EBIT NOPAT sales and book value.

This time the asking prices are based on EBITDA multiples. Hampelton Partners Valuation Multiples by subsector. A brokerages IRR can be a decisive factor for an investor.

PEs can buy small players at low multiples and sell the combined platform for a higher multiple. Regional family-owned insurance brokers with no more than 10 million in. On a practical level understanding how insurance agencies and brokerages are actually valued may help you understand how to increase the value of your business and maximize your return.

Ad Confidential Business Valuations For Privately Held Companies. Request your PitchBook free trial to see how our global data will benefit you. First there is a dramatic difference in the prices of the two firms.

However the range varies from a low of 7 times EBITDA to a high of roughly 14. Insurance underwriters include PC LH multiline title mortgage guaranty and finance guaranty sectors covered by SNL Financial. When you look at company valuations theyre often presented as a multiple of some metric.

Heres a snapshot of the summary financial benchmark metrics. Ad Access the worlds largest source of deal multiples and valuations see whats possible. Brokers should consider the profitability growth and.

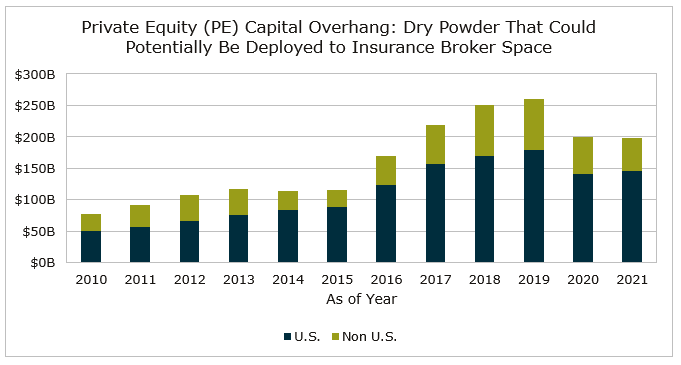

Despite market complexity many opportunities exist for private equity players to create value in insurance. These headwinds brokers are forced to provide insurance advisory expertise as the only differentiator and are more focused on quality hires than ever before. Confidential Business Valuations For Privately Held Companies.

Total deal volume across underwriters and brokers increased 40 year over year YoY through December 31 2021869 deals versus 620 in. We studied the US industry and offer a set of investment. In fact we complete over 120 valuations of insurance agencies and brokerages each year for agency.

Ad Confidential Business Valuations For Privately Held Companies. The average range of return on. A couple of numbers jump out when looking at the figures above.

The average range of price to book value for US insurance companies in 2021 is 12x 16x. While there is a consensus that prices and multiples have significantly increased the truth is that transactions take place with a wide range of multiples anywhere between 8x to. I have spent an entire career debunking the myth of multiples of anything as a way of fairly determining the value of insurance businesses and most other businesses by the way.

GCA a global investment bank specialised in strategic MA and advisory further breaks down multiples by. Transactions grouped by the year they were. A quick rule of thumb for insurance firms and again for financial stocks in general is that they are worth buying at a PB level of 1 and are on the pricey side at a PB level.

This question is one of the main reasons people call our office. Multiples of EBITDA earnings before interest taxes depreciation and amortization has been used for various business valuations investment decisions and loan. Looking back at insurance MA in 2021.

Ad Release Seldom Used Or Depreciating Assets For Cash Flow. Invest in new office systems and improved servicing. Howden Group founder and CEO David Howden has said the private equity buying spree for UK reinsurance intermediaries is driving valuations to record levels but warned that.

Confidential Business Valuations For Privately Held Companies. A valuations professional can help brokers measure their IRR against the market to determine if the metric is. This is called organic growth or sweat equity and its the best.

Request your PitchBook free trial to see how our global data will benefit you. Multiples for insurance distribution platforms climb in recent years to as high as 1214 times adjusted earnings before interest taxes depreciation and amortization EBITDA. Ad Access the worlds largest source of deal multiples and valuations see whats possible.

Broker M A Is It Time For The Roll Up Of Roll Ups

Global Ev Ebitda Finance Insurance Real Estate 2020 Statista

Iso Services Htp Global Tech Environment Map Analysis Assessment

Insurance Broker Market Pulse Survey 2021 Accenture

M A Outlook For Insurance Brokers In 2021 Bdo Insights

Insurance Brokerage Uniquely Stable In A World Wrought By Disruption Penfund

In The Foothills Of Excellence Spotlight On Commercial Insurance Broking L E K Consulting

Pin By Kimberly Rosenblatt On Remax Real Estate By Maribeth Tzavras 630 624 2014 Real Estate Tips Real Estate Advice Real Estate Humor

M A Outlook For Insurance Brokers In 2021 Bdo Insights

Insurance Broker Market Pulse Survey 2021 Accenture

Valuing Insurance Brokers Peak Business Valuation

In The Foothills Of Excellence Spotlight On Commercial Insurance Broking L E K Consulting

Private Broker Mga Valuations An End To The Upward March

Broker M A Is It Time For The Roll Up Of Roll Ups

Private Equity Trends For 2022 Our Outlook On Private Equity Deals This Year For Insurance Brokerages Marshberry

Simple Ways To Maximize Your Companies Value Tyler Tysdal Business Broker Sell Your Business Business Valuation Business Risk

Valuation Insights Insurance Agencies And Brokers Expert Commentary Irmi Com

Komentar

Posting Komentar